Kuhl's Safe Housing Vote (In Pictures)

Randy Kuhl's vote against the Housing Bill yesterday will not become a campaign issue in the 29th. The main provision of the bill would let the FHA re-insure underwater mortgages if the mortgage holder (bank) agrees to reduce the principal to 85% of the current home value.

In other words, in return for taking a loss, the bank gets the mortgage off their books. Since the homeowner must re-qualify for the loan, this program also weeds out borrowers who can't pay the new mortgage.

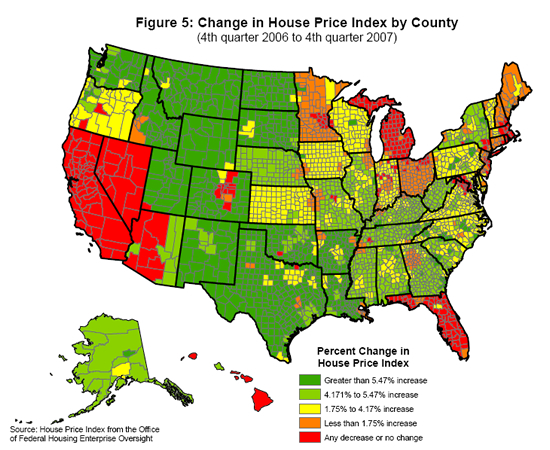

The reason this bill won't be an issue in the 29th is that we don't have many underwater borrowers. Take a look at this graph:

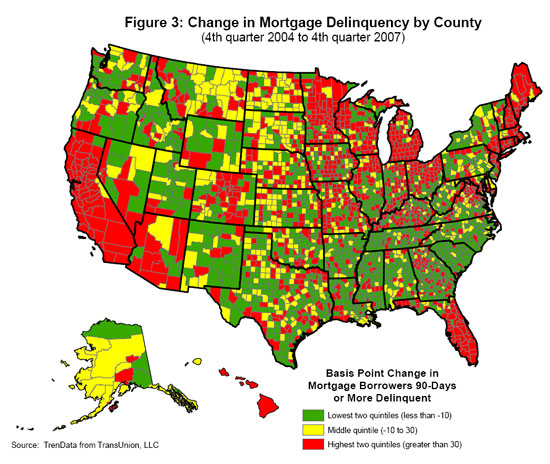

As you can see, the 29th had a small increase in house pricing. The sunbelt states and urban growth areas, where speculation was widespread, are where the prices are falling. The 29th is also doing fairly well in mortgage delinquency:

We seem to be able to pay our mortgages in the 29th, at least when compared to boom areas.

Whether Kuhl's vote was the right thing to do is worth debating, but, politically, I don't see a downside in his decision to stick with the rest of his party and vote against the bill.

(Graphs from the Federal Reserve via the excellent Calculated Risk blog.)